We’re All Leveraged, And In More Than One Context

My parents taught me about debt — mostly civic and financial — when I was a kid. Like a lot of life lessons there were points that clicked and others that showed up years later. Some I just didn’t want to hear. The universal truth about debt in any form is that it comes due.

Knowledge Debt

Knowledge debt is my favorite and the most loosely defined of the bunch. I think about knowledge debt as jumping into the deep end of any subject I need/want to understand, then learning my way to a level of proficiency meets the need. While it’s possible to take on too much knowledge debt (e.g. starting a business) you’ll almost always come out ahead on the investment.

Financial Debt

Financial debt is pretty clear cut on the personal & professional level — public & private equity, VC, bank loans & lines of credit, mortgages, car loans, credit cards. For non-economists, debt as a macro mechanism is well-explained by Ray Dalio, first in general terms, and then in a more recent interview (ignore the interviewer) about the economic impact of the coronavirus. Dalio’s writing and interviews are accessible and useful well outside the bounds of finance.

Technical Debt

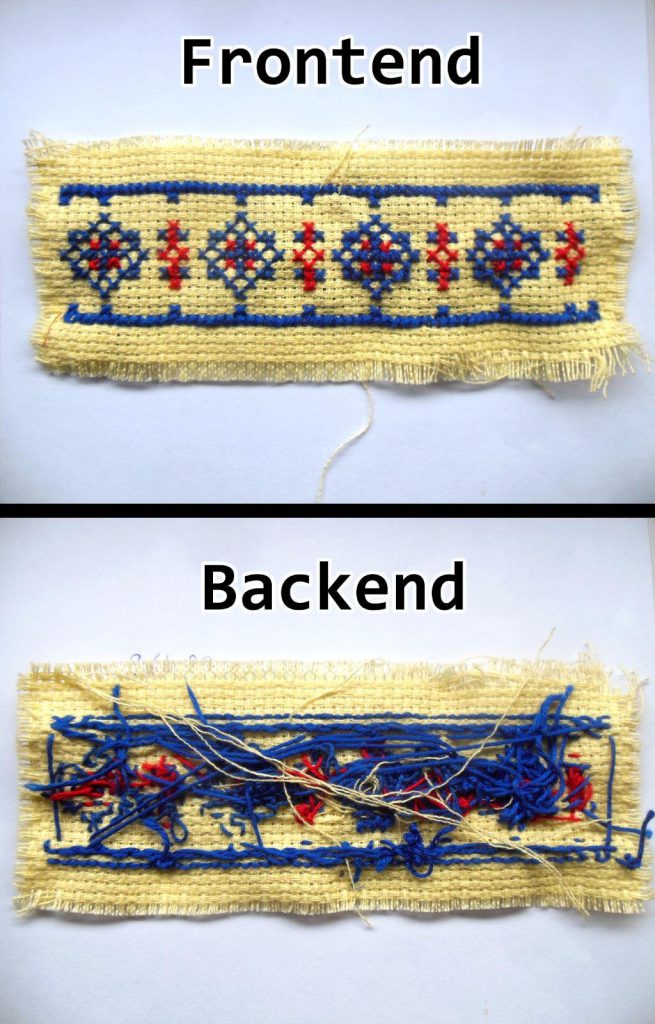

Technical debt takes the form of sloppy code, lax security, non-existent maintenance, or simple failure to act — in general terms, shortcuts and/or lack of sufficient investment in both hardware and software systems. This image will be familiar to anyone exposed to the software industry.

Agile software development is probably responsible for more undocumented technical debt that anyone knows or cares to admit. That’s fine for stable teams but if key people exit there’s big risk. Recent headlines about COBOL (a programming language first released in 1959) holding up unemployment payments in the US is a concerning example of unpaid technical debt in critical public systems. In the private sector, legacy banking systems have significant exposure to COBOL-related technical debt. Payment is coming due.

Operational Debt

Operational debt, adjacent to technical debt, accrues daily and with every decision. Accrual ramps exponentially during times of high-pressure / low information. A surprise balloon payment just came due for every company that delayed basic remote work protocols for eligible employees/roles. (This is being labeled technical debt by digital transformation marketers. It’s not. Baseline remote work systems & tools have been tables stakes for more than a decade.)

As we advance through the current technology revolution, what used to qualify as technical debt converts to operational debt (by way of inaction). Replacement or updated technology becomes available and first-time implementations become easier. Low/no-code is here. The barrier is a lack of trusted sources who support informed decision-making. It’s not a digital problem, it’s human.

Emotional Debt

Emotional debt is under-explored and unpopular to talk about. It’s like the way credit card debt is a sore subject when you’re maxed out across more than 1 card/creditor. As far as I can tell, we went off-track when social studies was repositioned as science and when emotional intelligence caught the popular imagination. Unflatteringly, the discipline that birthed EI tends to bristle at dissent.

I might be more empathetic toward the discipline if its vocal practitioners & proponents showed interest in refuting misrepresentations of purpose, meaning, safety, empathy, and vulnerability. Instead, “experts” peddle empathy as a sales tactic and Gen-xers praise Millennials who demand meaning-as-office-perk. I see no pushback from those qualified to speak up.

Note: I developed my ideas about emotional debt, in part, as a result of long-term exposure and side-by-side work with people I love and respect who are formally credentialed in social sciences, executive coaching, and related subjects. Disagreement ≠ animus.

The trend tracks to overprotective parenting and participation-trophy culture — and it extends into our adult & professional lives. That’s what I mean by emotional debt and it’s hard to say when/for whom the chits will get called in.

Why Does It Matter?

It matters because there’s an established pattern, under cover of “science,” of re-defining and replacing strength & service with navel-gazing. Its outcomes are landing on leadership — in families and in business. Advertising campaigns are now a source of purpose for me. The world at large is now responsible for making me feel safe, physically and ideologically. Broadcasting my self-diagnosed mental health status is the vulnerability we all need right now.

This is where CYBER-SHOUTING normally starts but that isn’t the point for leaders. The point is that feelings have been granted status as a reliable north star for decision-making. On their own, they are not. This challenge transcends age or ideology and puts leaders in a tight spot.

What Do We Do?

There are suggestions that global lockdown and its resulting economic fallout may deliver a wakeup call. David Brooks’ The Age Of Coddling Is Over (NYT, registration req) is one such take from an unexpected corner.

In the meantime, I’d suggest the solution is empathy in its authentic form. Leaders need to shoulder responsibility for emotional debt and create mechanisms to pay it down. A point of agreement I share with Simon Sinek is that the younger generations didn’t create or ask for this culture. They were groomed for it.

Imagine you find yourself leading a newly-remote team. Make yourself responsible for their ability to deliver. If someone can’t deliver, make it your mission to find out why (sometimes it will be private), find ways to get them what they need (you’ll face obstacles), or find ways to pick up the slack (they may be offended rather than grateful). Accept no excuses from yourself, and help them clear any excuses that may be blocking them.

It should be no surprise that a lot of solid advice comes from military leadership. Listen, Amplify, Include: Leadership for the Modern Age from an interview with Gen. Martin Dempsey, and What 9/11 Taught Us About Leadership in a Crisis, co-authored by Gen. Stanley McChrystal are both full of ideas.

This debt crisis extends beyond money. A payment is due.

Thomas Irre is the founder of HK5, LLC, Practical Business Technology and Mental Self-Defense for leaders & teams.